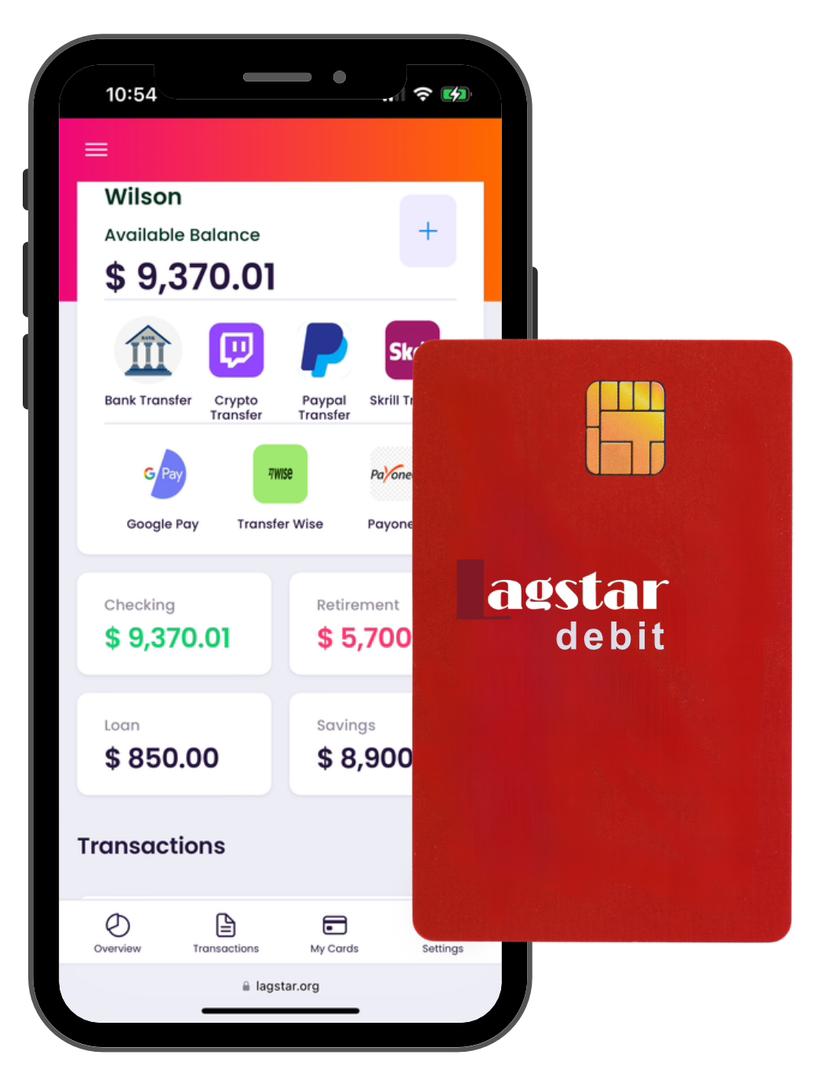

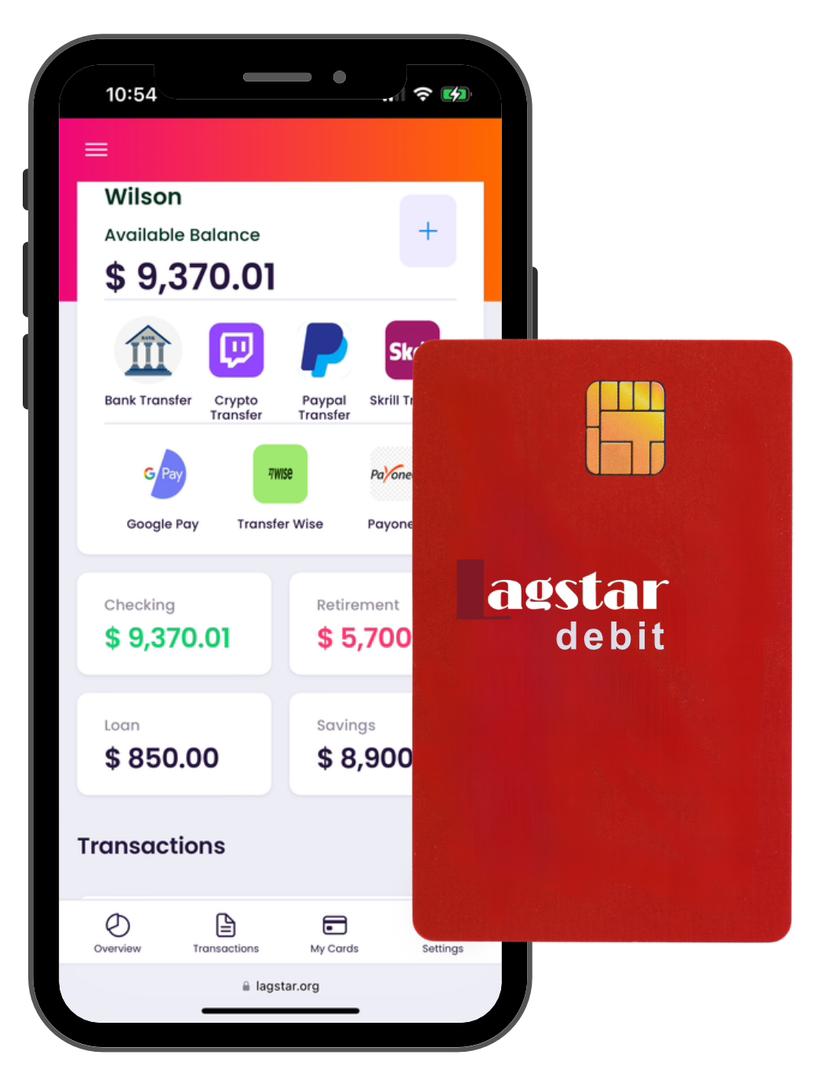

LagStar

Lagstar Community Bank is a dynamic consumer and commercial bank committed to fostering strong relationships tailored to meet clients at every stage of their financial journey. Our recent rebranding unites three institutions, marking a significant milestone in aligning operations, technology, and human resources to offer enhanced solutions and services to our valued consumer and commercial clients..

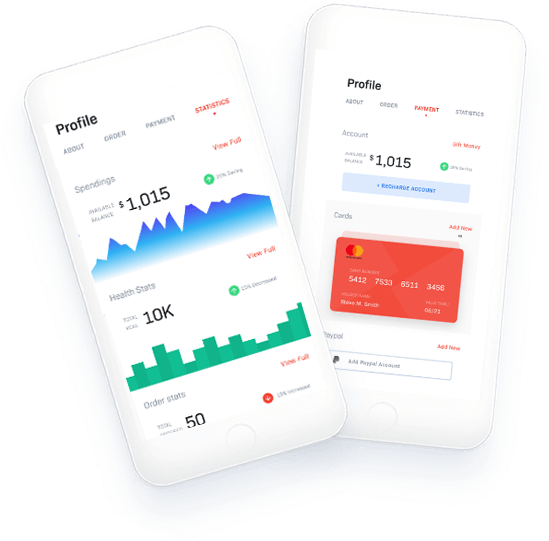

At Lagstar, alignment is fundamental to our ethos—we bring together people, technology, purpose, and objectives to deliver unparalleled banking experiences. We are a part of New York Community Bancorp, Inc., headquartered in Hicksville, NY, boasting $112.9 billion in assets, $83.3 billion in loans, $74.9 billion in deposits, and $8.4 billion in total stockholder equity. All banking transactions are done online, nearly 100 private client banking teams, and an extensive wholesale network, we cater to a wide range of financial needs including retail and multifamily lending, mortgage servicing, and more.

Our regional presence spans the Northeast, Midwest, Southeast, and West Coast, positioning us as a formidable player in the banking industry. Lagstar's core mission revolves around partnering with clients to define and achieve their goals, empowering them to succeed and prosper. Our focus on four key lines of business ensures that we deliver tailored solutions and unwavering support to all who entrust us with their financial well-being.

Financial consulting is a service provided by LagStars to large corporations, government agencies and individual clients. The role of our financial consultants is to provide an independent, expert opinion on a proposed business plan or decision. There are two main types of financial consulting: business and personal. We are available to send you in the right investment direction.